Investing can be rewarding to grow wealth, especially for small investors. However, many make the mistake of putting all their money in one place. Diversification is a smart strategy to reduce risk and increase potential returns. This article explores why diversification is essential for retail investors and the key benefits it offers.

Understanding Diversification

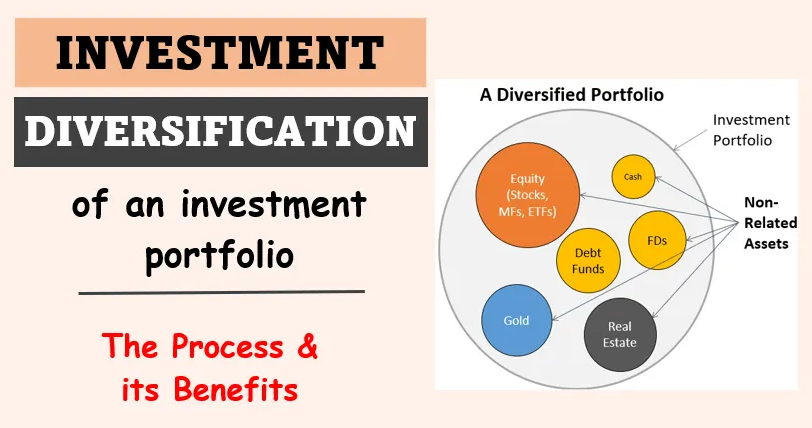

Diversification means spreading investments across different assets, such as stocks, bonds, real estate, and other financial instruments. The main goal is to lower risk. When one investment underperforms, others may do well. This balance can help protect the overall investment portfolio from significant losses.

Small-scale investors often face market volatility. By diversifying, they can minimize the impact of fluctuating pricA downturn can lead to steep losses if. If all investments are tied to one asset or sesses. Diversificatioisas a safety net, allowing investors to stay afloat even in uncertain times.

Reducing Risk

- One of the primary benefits of diversification is risk reduction. Different assets respond differently to market changes. For example, while tech stocks may rise during a boom, they can plummet during a recession. On the other hand, bonds may remain stable or even increase in value during market downturns.

- By diversifying, small-scale investors can create a balanced portfolio. This balance helps ensure that not all investments face the same risks simultaneously. For instance, if the stock market declines, bonds can provide a cushion, stabilizing overall returns.

Enhancing Returns

Diversificareduces risk and also enhances potential returns. When investors spread their money across various assets, they create opportunities to benefit from multiple growth avenues. Different sectors perform at different times, and a well-diversified portfolio with SoFi experts can capitalize on these performance variations.

Furthermore, diversification allows small-scale investors to explore emerging markets and trendsInvestingng in different industri allows investors toan tap into sectors that may offer higher growth potential. This approach can lead to better overall performance than sticking strictly to a single industry.

Improving Investment Discipline

Diversification can also help small investors develop better investment habits. With a varied portfolioreactingct impulsively to market chang is less temptinges. Investors are less likely to chase the latest trends or panic during market drops.

With a diversified strategy, small investors can focus on long-term goals rather than short-term fluctuations. This disciplined approach fosters a more informed decision-making process and encourages a patient investment mindset. As a result, investors can avoid common pitfalls caused by emotional responses to market volatility.

Navigating Market Volatility

Market volatility is a natural part of investing Economicic downturns, political changes, or global crises can increase uncertainty. Diversification equips small investors to navigate these turbulent times more effectively. Market volatility can create anxiety for many investors, but a diverse portfolio can help ease that stress. By holding different types of assets, small investors can better withstand sudden market dips since not all investments react the same way.

When markets tumble, a diversified portfolio tends to hold up better. Different asset classes react differently to economic events. For example, gold often increases in value during times of crisis. By holding a mix of investments, small investors can reduce the shocks of market volatility and maintain a more stable portfolio.

Diversification is vital for small investors aiming to build wealth while managing risk. By spreading investments across various assets, retail investors can reduce exposure to market volatility and enhance potential returns. This strategy not only promotes better investment discipline but also prepares investors to navigate uncertain times. Embracing diversification leads to a more balanced and resilient investment portfoliocriticaley for long-term financial success.